Homeowners Insurance: Definition, Coverage, Types, Examples

Table of Content

- Tips to help you write your Life Insurance Agent resume in 2022

- Skills you can include on your Insurance Investigator resume

- Common Homeowners Insurance Claims

- What Does Homeowners Insurance Cover?

- HO-2: Broad Form

- Tips to help you write your Insurance Agent resume in 2022

- Tips to help you write your Health Insurance Agent resume in 2022

If you get coverage through a company like Chubb or AIG, you’re likely getting HO-5 coverage. High coverage limits for expensive types of property with normally strict coverage limits, including jewelry, fine furs, and certain electronics. Basic policy forms generally aren’t offered by insurance companies anymore. Strong action verbs help recruiters understand your role in specific tasks. Insurance professionals’ resumes should use action verbs that are relevant to the sale of policies and the processing of claims.

An endorsement is optional coverage you can add to your homeowners policy to protect your home and property from types of loss not covered by standard insurance. Earthquakes, floods, government seizures, mudslides, ordinance updates, sewer backups and sinkholes are all perils that won't be covered by homeowners insurance, according to Hippo Insurance. Find the right homeowners insurance coverage with the right limits—at the right cost with one of our insurance advisors. Homeowners’ policies typically cover $100,000 in personal liability . This usually isn’t enough, since a single lawsuit can easily cost several hundreds of thousands of dollars.

Tips to help you write your Life Insurance Agent resume in 2022

It's called comprehensive because it covers both the structure of your home and your personal belongings from all damages unless specifically excluded. Because it gives you this added protection for your personal belongings, this policy is also more expensive than other policies. Most flood insurance policies are sold through FEMA’s National Flood Insurance Program .

If you follow the link below you will be taken to the sample home insurance policy. If you live in an area that is prone to frequent severe storms — like the East Coast — wind damage may be excluded from your insurance. If that’s the case, your insurer may offer wind coverage as an endorsement. In certain states where sinkholes are more common — like Florida and Tennessee — insurers may be required by law to offer sinkhole coverage. Sinkhole coverage helps pay to repair your home, its foundation, and it covers the cost of stabilizing the ground if your home begins to collapse into a sinkhole. Water backup coverage only covers water damage caused by sewer, drain, or sump pump backups.

Skills you can include on your Insurance Investigator resume

Homeowners who prefer to get their own insurance policy can compare multiple offers and pick the plan that works best for their needs. If the homeowner does not have their property covered from loss or damages, the bank may obtain one for them at an extra cost. Acts of war or acts of God such as earthquakes or floods are typically excluded from standard homeowners insurance policies. A homeowner who lives in an area prone to these natural disasters may need to get special coverage to insure their property from floods or earthquakes. However, most basic homeowners insurance policies cover events like hurricanes and tornadoes.

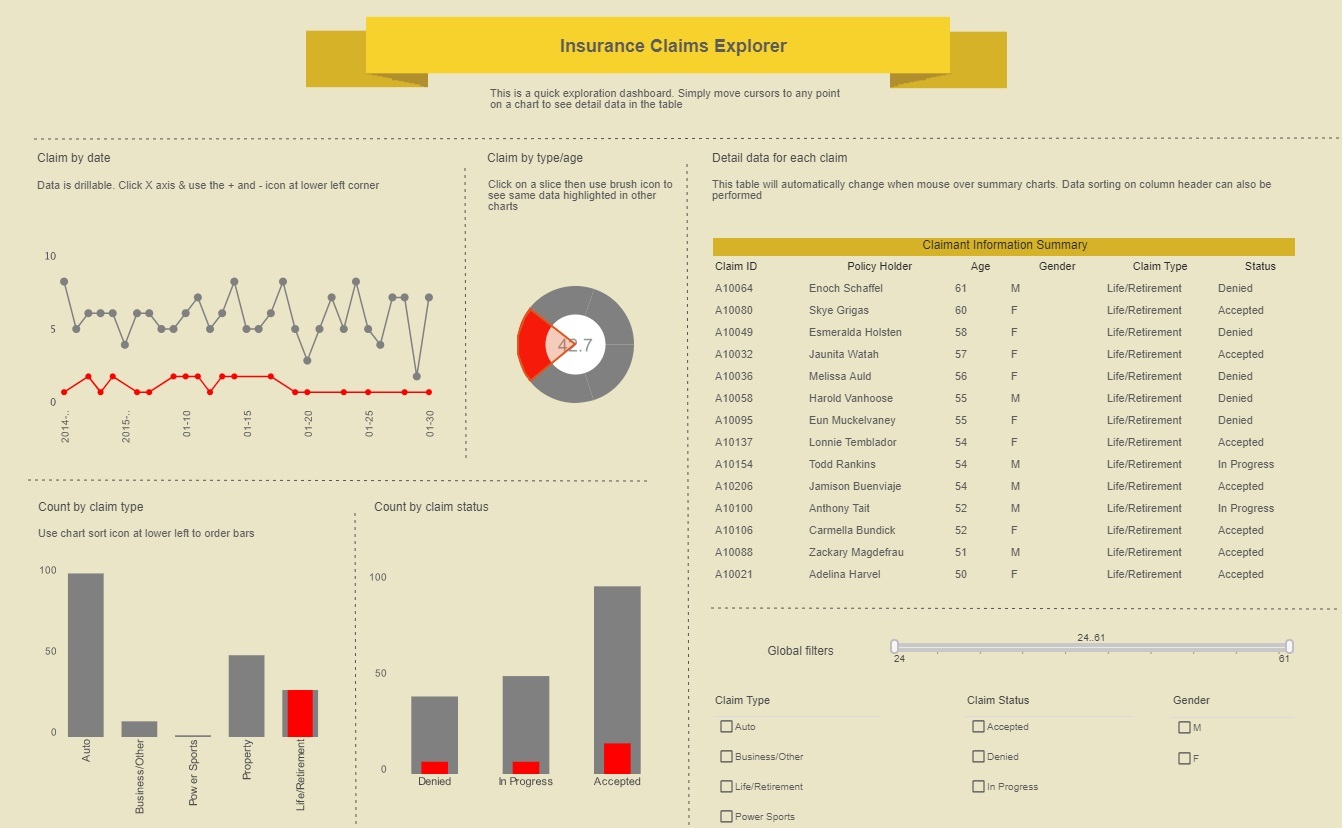

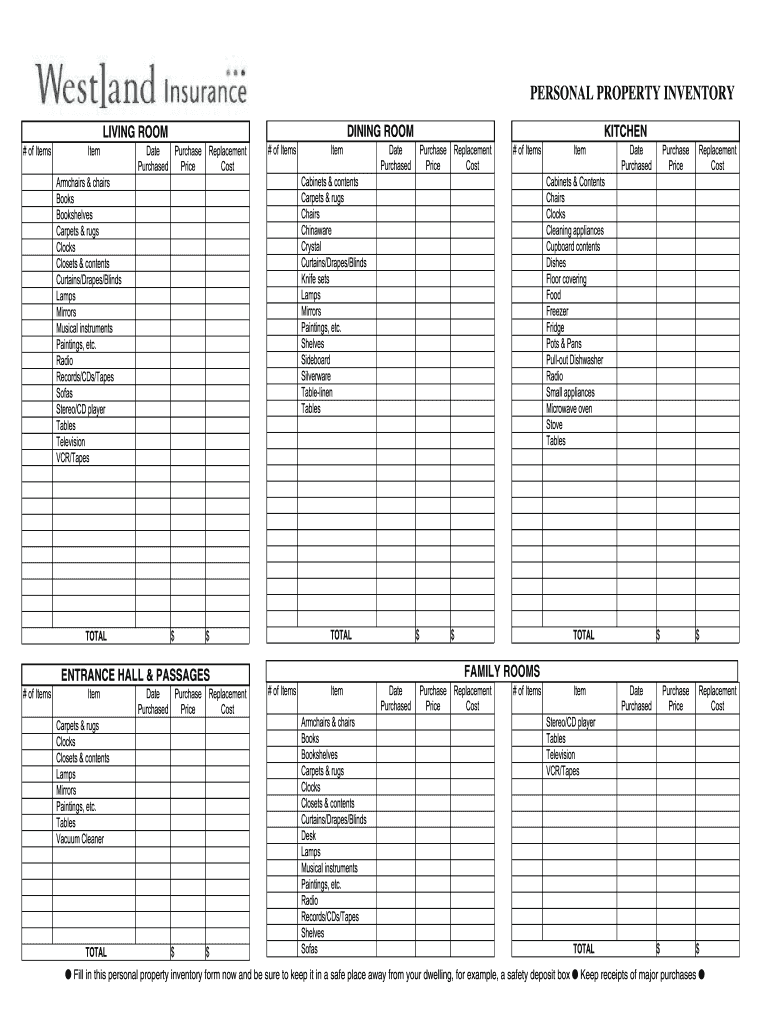

Let’s take a look at some of the most common home insurance claims, so you can ensure your homeowners’ policy is offering you the right coverage in the case of an incident. Type of homeowners insurance policy on the market, accounting for the vast majority of single-family home policies. Kara McGinley is a former senior editor and licensed home insurance expert at Policygenius, where she specialized in homeowners and renters insurance. As a journalist and as an insurance expert, her work and insights have been featured in Forbes Advisor, Kiplinger, Lifehacker, MSN, WRAL.com, and elsewhere. Homeowners insurance covers damages from lightning, fire, natural disasters, and more. It generally reimburses for the home and its contents, such as furniture and appliances, and provides liability coverage if someone gets injured on the property.

Common Homeowners Insurance Claims

For example, say a claim is made to an insurer for interior water damage that has occurred in a home. The cost to bring the property back to livable conditions is estimated by a claims adjuster to be $10,000. If the claim is approved, the homeowner is informed of the amount of their deductible, say $4,000, according to the policy agreement entered into.

Insurance investigators investigate claims that are suspected to be fraudulent. Like others in the insurance field, you can work in-house for one insurance company or as a sub-contractor for multiple insurance companies. Your investigations may range from following paper trails to physically surveilling claimants to prove fraud. Ensure your resume stresses your success in these areas most of all.

The HO-5 or Comprehensive form covers both the structure of your home and your personal belongings from all damages unless specifically excluded. An insurance sales agent’s job is to contact potential insurance customers and convince them to buy an insurance policy that suits their needs and budget. You may be meeting clients physically to discuss options, or virtually. This position includes a level of research as you source potential clients as well as admin tasks as you onboard new clients and get them registered with their policies. “Many homeowners don’t realize that flood damage is not covered under typical home insurance policies,” says Amy Danise, chief insurance analyst at Forbes Advisor. Whether your home is hit by lightning, hail, or some other calamity, you’ll be awfully glad you have a homeowners insurance policy in place to help foot the cost of repairs.

ISO stand for the Insurance Services Office and they are an organization that gathers data, creates policy forms and helps insurance companies provide actuarially sound insurance coverage. These variations all must generally conform to the law of the state the insurance customer lives in. However, you may need a separate policy or additional coverage if you live in certain areas, like Tornado Alley or along the Atlantic Ocean.

If you need more protection, you may be able to purchase a standalone sinkhole insurance policy. A dwelling under construction endorsement covers theft and damage to building materials while your home is under construction. You can also consider other supplemental coverage options like vacant homeowners insurance and builder’s risk insurance if you’re planning on living elsewhere while your home is being worked on.

Damage caused by slow leaks—technically “seepage and leakage”—can be denied coverage. Most city, state, or county governments have building codes around how homes must be built to ensure everybody's safety. Because building codes change frequently as construction techniques improve, it's likely your home isn't up to current building codes. You can expect to pay more in premiums once the project is done, since any additions or upgrades you made will increase your home’s rebuild value. In most cases, you need to pay a deductible of $250 to $500 before your coverage kicks in. Choose confidently with help from our team of expert insurance advisors.

Like other agents, you can work for one insurance company or act as a broker and sell life insurance from multiple insurance companies. This is a particularly difficult profession with over 90% of agents leaving the profession within one year. Contributing to the difficulty in the profession is the fact that you will most likely not be officially employed but will probably be retained as a contractor. In addition, you will most likely be based on a commission basis which means you will only receive wages for completed deals. Add to that, the fact that life insurance unlike motor insurance, is not compulsory to have, and is not considered important by large sections of the population.

The Federal Home Administration also requires it of those taking out an FHA loan. Your homeowners insurance dwelling coverage is based on your home’s replacement cost value, which is how much it’d cost to rebuild your home from the ground up with similar build materials. You can extend these coverage limits with an extended replacement cost endorsement. Special HO-3 insurance and mobile home insurance have open/all peril coverage for the dwelling structure, but your belongings are covered under named perils only. Your tasks will include finding leads, approaching them, finding them the best cover possible, and convincing them to buy a cover. To thrive you will need soft skills like communication skills and perseverance.

HO-3 policies also include liability coverage and loss-of-use coverage. Personal belongings are only covered for the listed potential dangers listed in the HO-2 form. Read this lesson to learn about the different forms of home insurance you can get. Each covers a set of dangers that can potentially affect your home and your belongings. The insurance costs can vary on factors, including the value and location of the home, the required coverage, and more. The average policy covers fire damage, wind damage, hail damage, theft, and vandalism.

Comments

Post a Comment