8 Types of Homeowners Insurance Policies

Table of Content

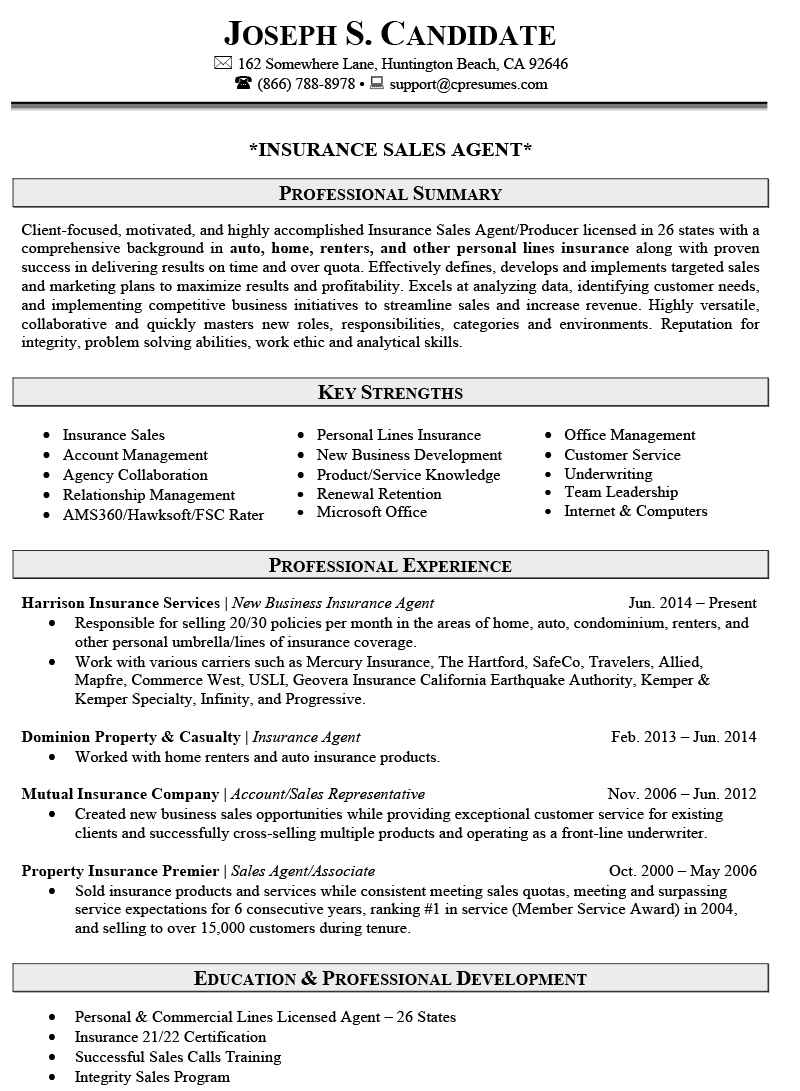

Pat Howard is a managing editor and licensed home insurance expert at Policygenius, where he specializes in homeowners insurance. An additional difference is that the HO-2 form also covers your personal belongings. This form of insurance does not cover any of your personal belongings.

If you have laptops, cameras, and other tech devices you use for work, that $2,500 may not be enough coverage to fully replace everything you lost if your home office was damaged or broken into. You can add service line coverage to your policy to enhance coverage for your service lines. During winter, ice and snow can cause a slipping or tripping hazard, increasing the potential of physical injury. For example, hanging heavy Christmas lights on roofs and gutters increases the risk of falling objects. Many or all of the offers on this site are from companies from which Insider receives compensation .

Special HO-3

Once in this position, you may undergo further training to allow you to specialize within the insurance industry. Insurance claims managers will handle insurance claims as they are processed. Your tasks may include giving clients advice, investigating their claims, and ensuring their claims are processed to completion efficiently and fairly. You will have the added responsibility of managing a team in the claims department. You will be in charge of maximizing productivity and efficiency in processing claims. It is sometimes hard to judge the quality of an applicant’s underwriting experience without seeing them in action on a case.

Let’s take a look at some of the most common home insurance claims, so you can ensure your homeowners’ policy is offering you the right coverage in the case of an incident. Type of homeowners insurance policy on the market, accounting for the vast majority of single-family home policies. Kara McGinley is a former senior editor and licensed home insurance expert at Policygenius, where she specialized in homeowners and renters insurance. As a journalist and as an insurance expert, her work and insights have been featured in Forbes Advisor, Kiplinger, Lifehacker, MSN, WRAL.com, and elsewhere. Homeowners insurance covers damages from lightning, fire, natural disasters, and more. It generally reimburses for the home and its contents, such as furniture and appliances, and provides liability coverage if someone gets injured on the property.

HO-2: Broad Form

Show your competency as a manager of a team by listing your team’s successes. If your team has won any internal or external awards for their work, include that as well. Remember that you are obligated to get the best cover for your potential clients. You will almost definitely be using some kind of a CRM to keep track of your leads and the status of your engagement with each lead. So become experienced with all the main CRM software and list all the CRMs you are comfortable with in the tools section of your resume. This is a very technical job and technology is constantly evolving.

Depending on where you would like to work, however, you may need to be certified or licensed by the relevant governing body. If such certification is needed, ensure you list your relevant certifications in your resume. Property insurance provides financial reimbursement to the owner or renter of a structure and its contents in the event of damage or theft.

Does home insurance cover wear and tear?

Your resume should highlight your experience with industry-standard technologies and software as well as your experience and educational background. It would be easy to craft your resume around your communication and negotiation skills. But a significant part of your job will include administrative work.

It is actually a revised HO-2 form and addresses the fact that condominium and co-op owner tenants have both personal areas and common areas. Common areas are not covered under the policy since the association or cooperative will have insurance that covers those areas. Each condo or co-op will have a list of insurance requirements letting you know how much insurance you need to purchase.

Have a lightning rod on the top of your house that directs lightning to minimize damage. Have a smart lighting system that turns lights on at different intervals. This keeps your house lit while you’re not home, which can deter burglars from coming in.

This will include writing reports, processing claims and policy registrations, etc. To bolster your resume further, quantify the administrative workload that you can and have handled. To do this job you should be outgoing and have strong intrapersonal and negotiation skills.

Your condo policy also includes personal property, loss of use, personal liability, medical payments, and loss assessment coverage. Coverage for your home and cover your personal property from the same named perils in HO-1 and HO-2 policies. All-risks, or open-perils coverage, means you’re covered for everything except the causes of loss that are specifically excluded in your policy. However, your personal belongings are only covered for the listed potential dangers listed in the HO-2 form. A homeowners insurance policy also differs from mortgage insurance. Mortgage insurance is typically required by the bank or mortgage company for homebuyers making a down payment of less than 20% of the cost of the property.

The HO-5 or Comprehensive form covers both the structure of your home and your personal belongings from all damages unless specifically excluded. An insurance sales agent’s job is to contact potential insurance customers and convince them to buy an insurance policy that suits their needs and budget. You may be meeting clients physically to discuss options, or virtually. This position includes a level of research as you source potential clients as well as admin tasks as you onboard new clients and get them registered with their policies. “Many homeowners don’t realize that flood damage is not covered under typical home insurance policies,” says Amy Danise, chief insurance analyst at Forbes Advisor. Whether your home is hit by lightning, hail, or some other calamity, you’ll be awfully glad you have a homeowners insurance policy in place to help foot the cost of repairs.

In our latest installment of our Home Buyer’s Guide to Home Insurance, we’ll flag certain things that most standard policies exclude. Don’t bank on your insurance company footing the bill for the following unfortunate situations. Yet while home insurance typically covers a variety of common hazards that can befall your home, don’t get too confident, because it may not cover every mishap that comes your way. Cover your home due to the increased risk of theft, vandalism, and storm-related damage.

Comments

Post a Comment